Ach Processing Things To Know Before You Buy

Regardless of what type of ACH settlements are involved, a transfer is a procedure of 7 actions, which starts with the money in one account and finishes with the cash arriving in an additional account. ACH repayments begin when the pioneer (payer)begins the procedure by requesting the deal. The producer can be a consumer, service, or a government company.

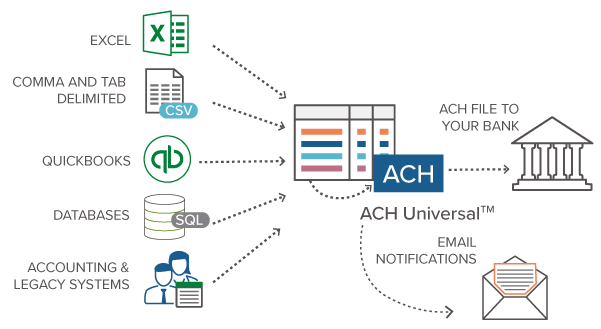

As soon as a deal is started, an entry is sent by the bank or repayment processor handling the initial stage of the ACH payments process. The financial institution or settlement cpu is called the Originating Depository Financial Institution (ODFI). Banks usually send out ACH access in batches, normally 3 times a day during routine service hours.

Reserve bank as well as the EPN are nationwide ACH operators. When gotten, an ACH driver sorts the set of entries into down payments and payments, as well as settlements are then arranged right into ACH credit and also debit payments. This ensures that money is moved in the best instructions. After arranging entries, the ACH driver sends them to their destined financial institution or monetary institution, referred to as an Obtaining Vault Financial Organization (RDFI).

The Best Guide To Ach Processing

Lastly, when receiving ACH settlements, the receiving monetary establishment either credits or debits the obtaining financial institution account, depending upon the nature of the purchase. While the total price linked with approving ACH payments differs, ACH costs are typically more affordable than the fees connected with accepting card repayments. Among the greatest cost-influencers of accepting ACH payments is the quantity of purchases your business plans to process.

When accessing ACH indirectly through a 3rd party Settlement Processor (TPPP), a variety of kinds of charges might be involved: While both cord transfers (like SWIFT) and also ACH settlements permit electronic payment of funds to bank accounts, the primary difference is that wire transfers are made use of to assist in international settlements, whereas digital ACH payment is just available domestically. Whether you're an acquirer, repayments processor or vendor, it's vital to be able to gain complete real-time visibility into your repayments environment. Inadequately doing systems boost aggravation throughout the whole payments chain. Bringing real-time exposure and also repayment monitoring to your whole setting, Transact uncovers click site unrivaled understandings right into ACH deals and payments fads to assist you enhance the settlements experience, transform information into knowledge, and assure the repayments that keep you in service.

The Best Strategy To Use For Ach Processing

Opportunities are you have actually already utilized ACH payments, but are not acquainted with the jargon. ach processing. Some of the examples of ACH purchases include: Online bill payments via your bank account, Transferring money from one bank account to an additional, Paying suppliers or obtaining cash from consumers using straight down payment, Straight down payment pay-roll to an employee's monitoring account used by companies, Allow's discover ACH settlement processing a lot more in information.

, ACH settlements per day surpassed 100 million in February 2019. 1% boost in ACH transaction volume for the first quarter of 2020, with B2B payments publishing an 11.

You move cash to a Silicon Valley Bank account from your Bank of America account. Both the financial institutions have to credit rating and also debit each various other's accounts.

In this manner, the fund transfer takes place just when. ACH is more tips here one such central clearing up system for financial institutions in the United States. It runs by means of two clearing up centers: the Reserve bank and The Cleaning Home. Cable transfers are interbank electronic settlements. While cord transfers seem to be comparable to ACH transfers, here are some vital differences between them: Can take a couple of service days, Instantaneous, Free for a receiver, small their explanation costs ($1) for a sender, Both the sender and also receiver are charged costs.

8 Simple Techniques For Ach Processing

Can be disputed if conditions are satisfied, Once initiated, can not be canceled/disputed, No human treatment, Generally includes bank workers, Both send out and also request payments. For repayment requests, you need to upload the ACH file to your financial institution.

Your client authorizes you to debit their checking account on his part for repeating transactions. Allow's state Jekyll needs to pay a sum of $100 to Hyde (think they're two various individuals) as well as makes a decision to make an electronic transfer. Here is a step by step malfunction of how a bank transfer through ACH works.